FutureMoney Pro: Lifetime Subscription

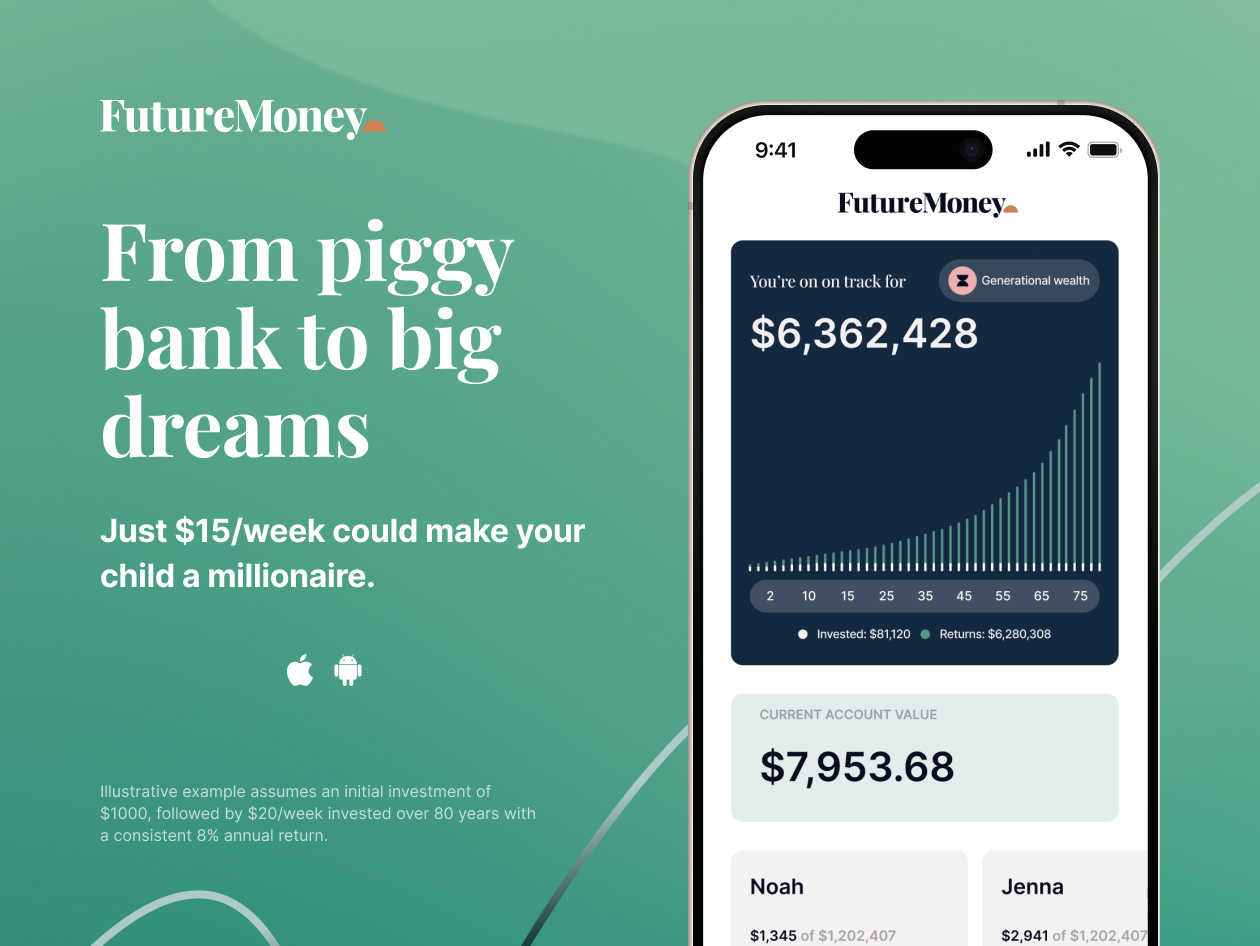

Grow Generational Wealth for Your Kids with This All-in-One Platform's Automated Contributions, Tax-Advantaged Investing, Flexible Goals & More

Description

Secure Their Dreams, One Investment at a Time

Give your children the best start in life with FutureMoney—a simple way to build a strong financial future starting today. FutureMoney is a modern investing app built specifically for parents who want to give their children a financial head start.

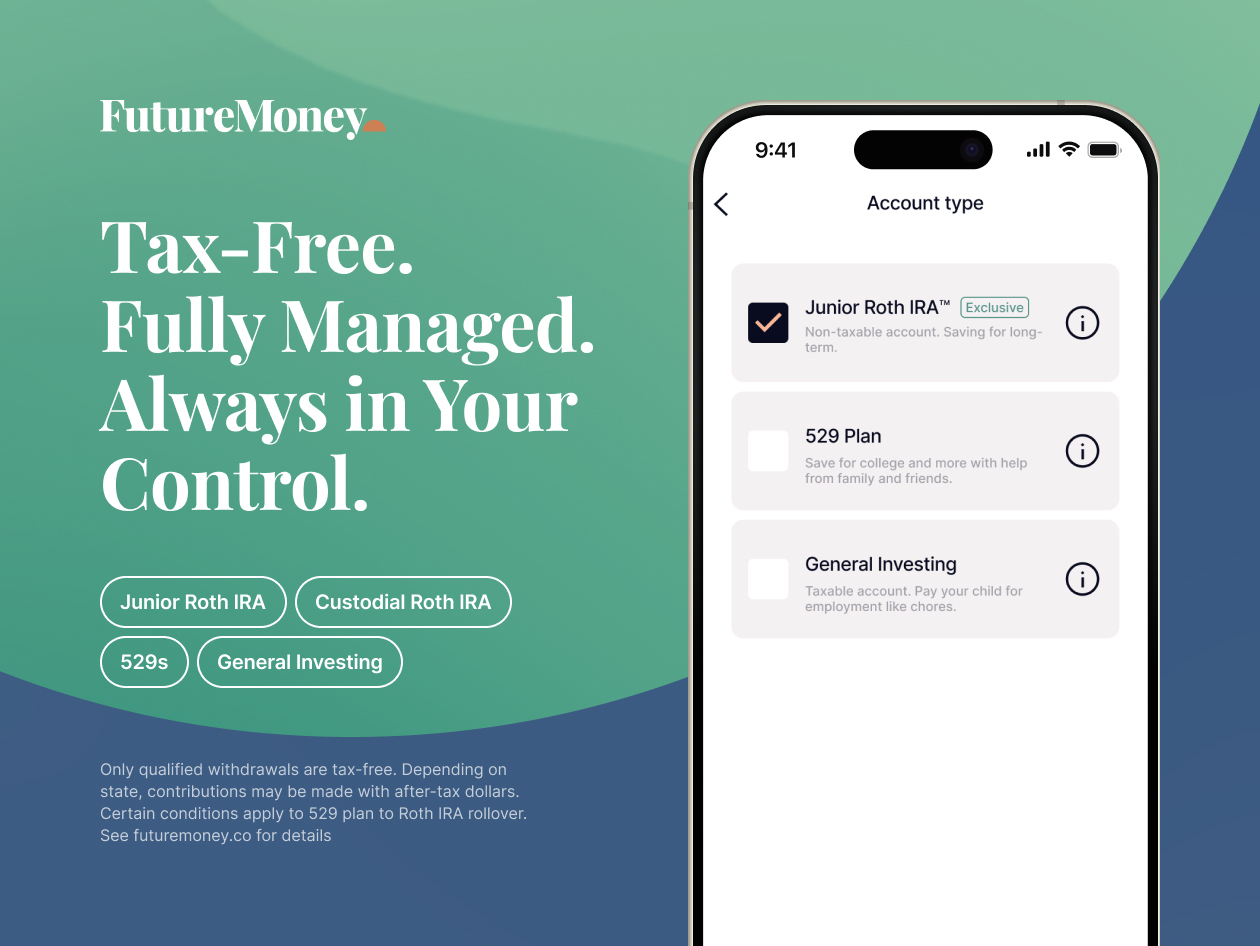

Whether you're saving for your kid's college, their first home, or long-term independence, FutureMoney helps you invest early, grow smarter, and make the most of tax-advantaged tools like Junior Roth IRAs and 529 plans. It also supports shared goals, so couples and family members can invest together, while maintaining control and visibility.

With this exclusive deal, you won’t pay any monthly subscription fees, and contributions from friends and family can be added directly to your child's account—making FutureMoney not just an investment app, but a movement toward building generational wealth, starting with everyday families.

Designed by fintech veterans with a track record of building trusted financial products, FutureMoney is as intuitive as it is impactful.

*Disclaimer: These ratings are independently calculated and published by Apple Inc. and Google LLC, respectively. The Apple App Store rating is based on the average of all user-submitted app reviews to date, while the Google Play rating emphasizes more recent user feedback. App ratings and user reviews reflect general app experience and usability, and may not represent the experience of FutureMoney clients with its advisory services or investment performance. Ratings are not based on client satisfaction surveys or verified advisory outcomes. The Apple App Store and Google Play Store do not verify whether reviewers are clients of FutureMoney or use its investment services. Ratings are subject to change and are updated by each platform independently. For the most accurate and current rating information, please visit the FutureMoney app listing in the Apple App Store or Google Play Store.

Why FutureMoney?

- Children's Accounts: Offers comprehensive account types for minors & an exclusive Junior Roth IRA.

- Easy Account Opening: Get started quickly with a simple setup process.

- Low Fees: Benefit from one of the lowest fees available for a fully managed portfolio.

- Tax-Advantaged Options: Choose from several types of accounts with tax advantages that help keep more money in the family as you build your wealth.

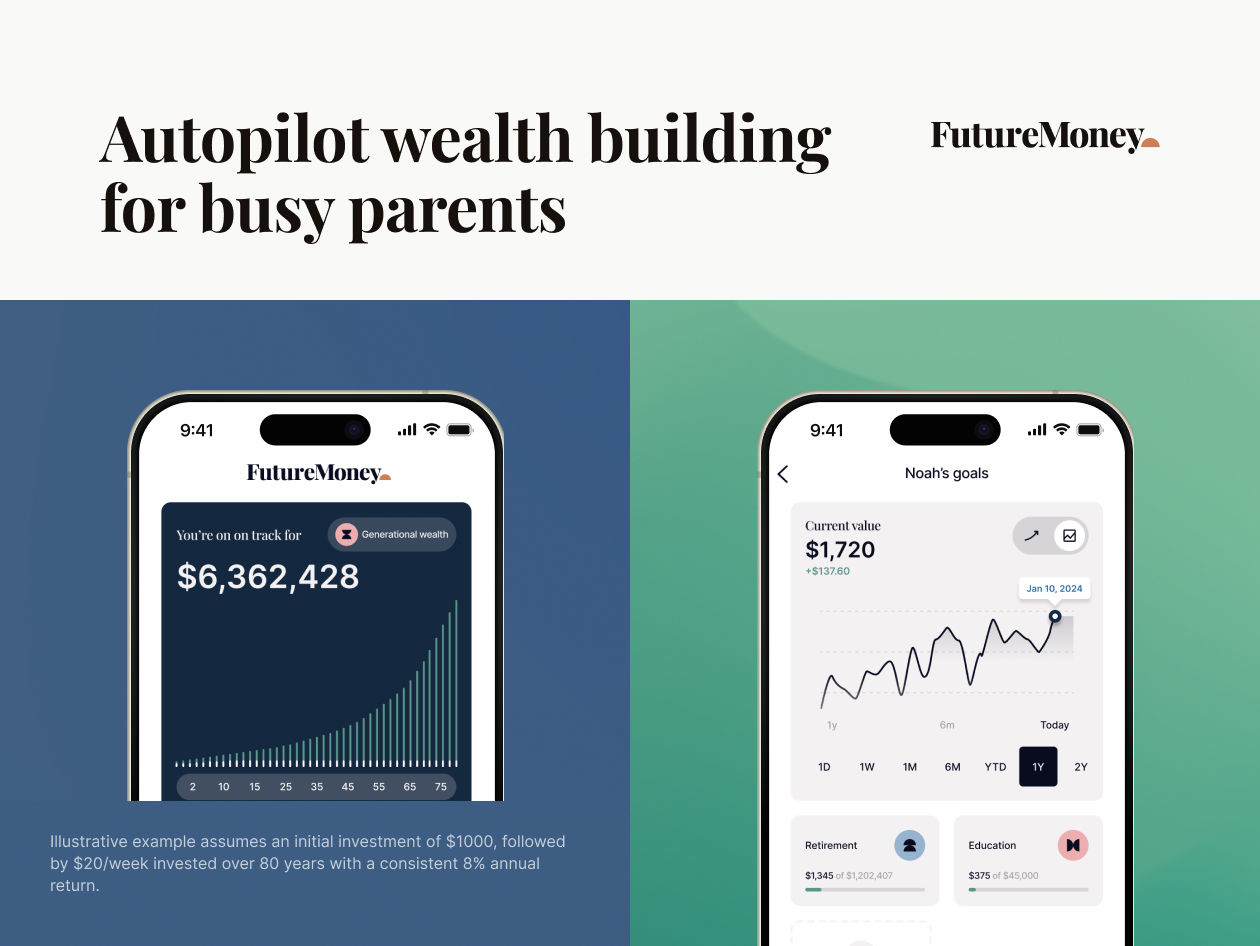

- Automated Contributions: Set it & forget it—schedule recurring investments to grow their future effortlessly.

- Transparency for Co-Parents: Share account progress with your co-parent while keeping financial boundaries clear.

- Flexible Goals: Save for education, a first home, or long-term independence—all in one place.

- Gifting for Friends & Family: Family and friends can contribute directly to what matters most

- Security: Funds are held at BNY Mellon | Pershing with up to $500,000 in SIPC protection.

Investing for your kids’ future

- Start Early, Save Big: The earlier you invest, the more your money can grow through the power of compound returns.

- Tax-Advantaged Investing: Maximize your savings with options like Junior Roth IRAs and 529 plans designed for long-term growth.

- Flexible Goals: Invest for education, a first home, or future financial independence—all on one easy platform.

Why start now?

- Maximize Compounding: Early contributions have more time to grow, turning small investments into big outcomes.

- Reduce Future Stress: Prepare now to ease financial burdens during major life milestones like college or homeownership.

- Teach Financial Literacy: Get your kids involved and help them understand the value of saving and investing early.

FutureMoney Pro Plan

*Minimum contribution for all new users is $5.

- Management Fee: 0.25%

- Roth IRA

- Traditional IRA

- General Investing

- 529 Accounts

- Generational Wealth

Real reviews from FutureMoney users

"Saving for my son’s college fund felt overwhelming until I found this app. They helped me develop a step-by-step investment strategy that feels practical and achievable. I feel much better knowing I’m building a solid foundation for his future."

"I chose this company to secure my child’s financial future, and it was the best decision. Their platform is intuitive, and their advisors helped me create a solid savings plan. I love knowing that I’m setting my child up for success when they grow up."

- For NEW users in the United States ONLY.

- Users should be 18 years old or above.

- Minimum contribution for all new users is $5.

- Users must then continue with a minimum weekly contribution of $5 thereafter to maintain access.

- This is a financial product. Once a bonus is applied or funds are deposited, the offer is non-refundable.

- All investments involve risks, including the possible loss of capital. The use of FutureMoney’s platform is subject to eligibility requirements and terms of service. See futuremoney.co for details.

- Hypothetical returns shown, not actual performance. Investing involves risk of loss, and performance is not guaranteed.

- Promotional bonus may not be withdrawn for 36 months. For full terms and conditions, visit futuremoney.co/legal-privacy

- General investing accounts are taxable.

- The testimonials provided may not be representative of the experience of other FutureMoney users, and there is no guarantee that all FutureMoney users will have similar experiences.

- Your investments are eligible for protection of up to $500,000 (including $250,000 for cash) under SIPC coverage in the event of a brokerage firm's financial failure. SIPC coverage does not protect against market losses.

Specs

System Requirements

- Web: latest version of Chrome, Safari, Firefox, or Edge

- iOS: Supports latest iOS (via App Store)

- Android: Android 10+ or newer (via Google Play)

Important Details

- Length of access: lifetime

- Redemption deadline: redeem your code within 30 days of purchase

- Access options: mobile or desktop

- Available on iOS / Android / Web

- Max number of device (s): unlimited

- Available to NEW users ONLY

- Phone number can only be linked with one email/account

- Updates included

- Have questions on how digital purchases work? Learn more here

- Learn more about our Lifetime deals here!

Terms

- Unredeemed licenses can be returned for store credit within 30 days of purchase. Once your license is redeemed, all sales are final.

- FutureMoney reserves the right to revoke lifetime access to the pro plan if the user violates the terms of service, including failure to verify their identity, not actively utilizing the product, or using the product in a fraudulent or unauthorized manner.